In regards to the documentation required upon loan application, the borrower will need to provide the following:

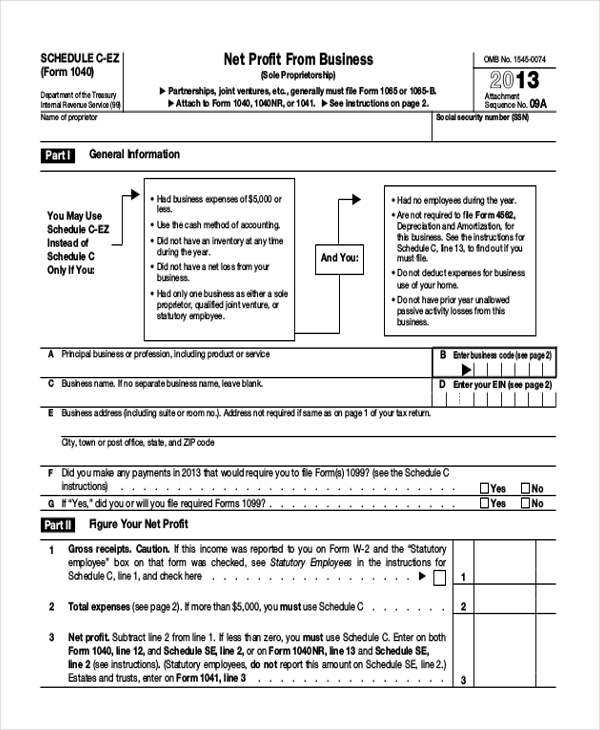

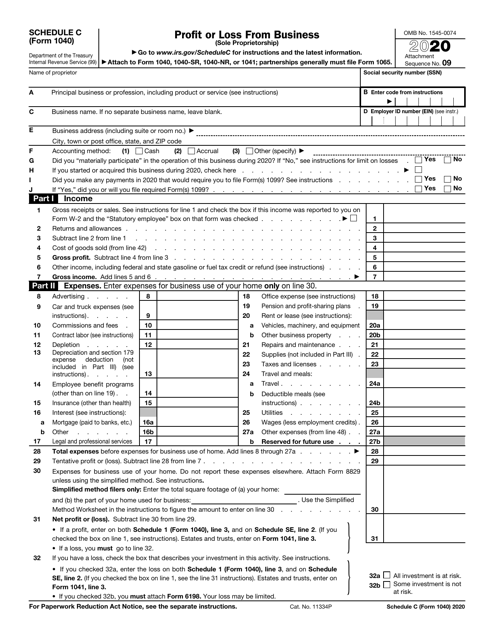

For a detailed understanding of the calculation, please refer to page 10 of the IFR. Unfortunately, if your PPP loan has already been approved as of the effective date (March 3, 2020), you cannot increase the PPP loan amount based on the calculation methodology. Gross income will result in a higher loan amount. You do have the choice to use either Net Profit (Line 31) or Gross Income (Line 7) for your loan amount calculation. The total Gross Income and payroll costs would then be divided by 12 and multiplied by 2.5.

#SCHEDULE C TAX FORM PLUS#

If you are an owner with employees, your PPP loan would be equal to Gross Income on Schedule C, Line 7 plus compensation, health benefits, and retirement costs paid to your employees (payroll costs).If you are an owner with no employees, your PPP loan would be equal to Gross Income on Schedule C, Line 7 divided by 12 and multiplied by 2.5.The SBA determined these changes would reduce barriers to accessing the PPP and expand funding among the smallest businesses.

This change includes covering business expenses as well as Net Profits. The SBA made this change to better reflect the fixed and other business costs that a small business must cover to stay in operation, therefore keeping the owner employed. Prior to this IFR, the owner’s compensation of the loan amount calculation was limited to the net earnings reported on Schedule C Line 31. The SBA has also created two new loan application forms for Schedule C filers using Gross Income – first draw application (Form 2483-C) and second draw application (Form 2483-SD-C). All of these changes apply to both the first and second draw of PPP loans. The IFR also removed the eligibility restriction that (1) prevents businesses with owners who have non-financial fraud felony convictions in the last year from obtaining PPP loans and (2) removes the eligibility restrictions that prevent businesses with owners who are delinquent or in default on their Federal student loans from obtaining PPP loans. On March 3, 2021, the Small Business Administration (SBA) issued a new Interim Final Rule (IFR) relating to the Paycheck Protection Program (PPP) that now allows these borrowers to use either Gross Income or Net Profit as reported on Schedule C to maximize the loan amount. Great news for sole proprietors, independent contractors and self-employed individuals who file IRS Form 1040, Schedule C for their business operations. Forensic Accounting/Fraud Investigations.Financial Statement Attestation Services.

0 kommentar(er)

0 kommentar(er)